Understanding the requirements for trailer insurance is crucial for any trailer owner when it comes to road safety and legal compliance. Whether you’re hauling a travel trailer, utility trailer, or boat trailer, knowing which states mandate insurance coverage can save you from unexpected legal and financial consequences. Trailer insurance is not just about adhering to state laws; it’s about protecting your investment and ensuring peace of mind while on the road.

In this comprehensive guide, we will delve into the specifics of trailer insurance, explore the states that require it, and provide valuable insights into the types of coverage available, additionally, we’we’llscuss the benefits of having separate trailer insurance and offer practical advice on selecting the best policy to suit your needs. By the end of this article, youyou’lluippedhe the knowledge to make informed decisions about insuring your trailer, ensuring that you stay compliant and secure in every state you travel through.

Table of Contents

Understanding Trailer Insurance

What is Trailer Insurance?

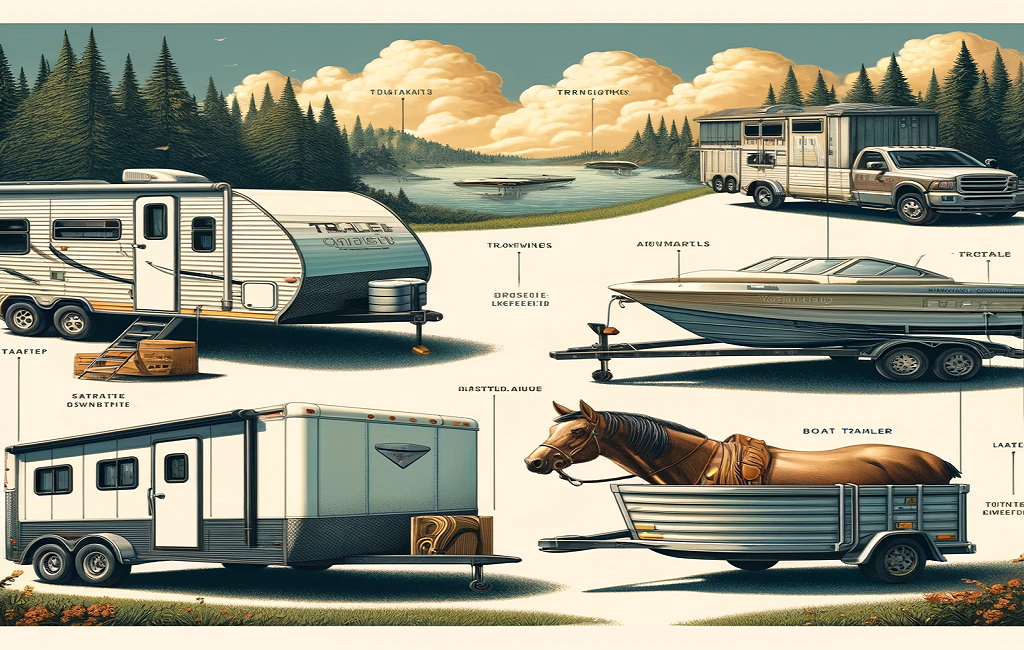

Trailer insurance is a specialized form of coverage designed to protect trailers, including travel trailers, utility trailers, boat trailers, and more. Unlike standard auto insurance, which primarily covers vehicles, trailer insurance provides specific protections tailored to the unique risks associated with trailers. This insurance can cover a range of scenarios, from accidents and theft to natural disasters and liability claims.

Types of Trailers Covered

- Travel Trailers: These are trailers designed for recreational use, often equipped with living quarters. Examples include fifth wheels, pop-up campers, and traditional travel trailers.

- Utility Trailers: These are open or enclosed trailers used for transporting goods, equipment, or vehicles. Businesses, contractors, and homeowners commonly use them.

- Boat Trailers: Trailers specifically designed to transport boats. Coverage for these trailers ensures that your boat is protected during transit.

- Horse Trailers are trailers used to transport horses. Insurance for these trailers often includes coverage for the animals being transported.

- Cargo Trailers: Enclosed trailers are used to transport various types of cargo. These are popular among businesses for transporting tools, equipment, and inventory.

Why Trailer Insurance is Important

Trailer insurance is essential for several reasons:

- Legal Compliance: Many states require trailer owners to carry specific insurance. Failing to comply with these laws can result in fines, penalties, and other legal issues.

- Financial Protection: Trailers represent a significant investment. Insurance protects this investment from damage, theft, and other risks, reducing out-of-pocket expenses in the event of an incident.

- Liability Coverage: Accidents involving trailers can lead to costly liability claims. Trailer insurance provides coverage for bodily injury and property damage caused to others, protecting you from financial liability.

- Peace of Mind: Knowing that your trailer is covered provides peace of mind, allowing you to focus on your travels or business operations without worrying about potential risks.

In the next sections, we will explore which states require trailer insurance and the specific coverage types you should consider to ensure comprehensive protection for your trailer.

States that Require Trailer Insurance

Overview of State Requirements

Trailer insurance requirements vary significantly from state to state. While some states mandate specific types of coverage for trailers, others may not require insurance at all. Understanding these state-specific regulations is crucial for ensuring legal compliance and protecting your investment. Below, we provide an overview of states that require trailer insurance and the general nature of these requirements.

States that Require Trailer Insurance

Overview of State Requirements

Trailer insurance requirements vary significantly from state to state. While some states mandate specific types of coverage for trailers, others may not require insurance at all. Understanding these state-specific regulations is crucial for ensuring legal compliance and protecting your investment. Below, we provide an overview of states that require trailer insurance and the general nature of these requirements.

State-by-State Breakdown

- California

- Requirement: Liability insurance is required for all trailers, including travel and utility trailers.

- Details: Coverage must meet the state’s minimum liability limits.

- Texas

- Requirement: Trailers with a gross vehicle weight rating (GVWR) of 4,500 pounds or more must have liability insurance.

- Details: The policy must provide coverage for bodily injury and property damage.

- Florida

- Requirement: Trailers used for commercial purposes must have liability insurance.

- Details: Personal trailers do not require separate insurance but should be covered under the towing vehicle’s policy.

- New York

- Requirement: Liability insurance is required for all registered trailers.

- Details: The insurance must meet the state’s minimum liability requirements.

- Pennsylvania

- Requirement: Trailers over a certain weight (typically over 3,000 pounds) must have liability insurance.

- Details: Coverage must include bodily injury and property damage liability.

- Massachusetts

- Requirement: All trailers must be insured with at least the minimum liability coverage.

- Details: Trailers are considered extensions of the towing vehicle, but separate coverage is often recommended.

- New Jersey

- Requirement: Liability insurance is mandatory for trailers.

- Details: The policy must provide at least the state’s minimum coverage levels.

- Nevada

- Requirement: Trailers must have liability insurance if they are registered and operated on public roads.

- Details: The insurance must meet state minimum liability limits.

- South Carolina

- Requirement: Liability insurance is required for all trailers.

- Details: The insurance must cover both bodily injury and property damage.

- Illinois

- Requirement: Liability insurance is required for trailers over a certain weight.

- Details: Typically, trailers used for commercial purposes need separate insurance.

States with No Specific Insurance Requirements

Some states do not require separate trailer insurance but still recommend it to ensure comprehensive protection:

- Arizona

- Ohio

- Colorado

- Indiana

In these states, while insurance is not legally mandated, having a separate trailer policy can provide additional coverage and peace of mind.

Understanding State-Specific Details

Each state has its regulations regarding trailer insurance, often tied to the trailer’s (personal vs. commercial) and weight. It’s essential to check with your state’s Department of Motor Vehicles (DMV) or equivalent agency to understand the specific requirements. Additionally, consulting with an insurance agent can help ensure you meet all legal obligations and have the right coverage for your trailer.

In the next section, we will discuss the key considerations for trailer insurance, including different types of coverage and what they protect against.

Understanding State-Specific Details

Each state has its regulations regarding trailer insurance, often tied to the trailer (seasonal vs. commercial) and weight. It’s essential to check with your state Department of Motor Vehicles (DMV) or equivalent agency to understand the specific requirements. Additionally, consulting with an insurance agent can help ensure you meet all legal obligations and have the right coverage for your trailer.

In the next section, we will discuss the key considerations for trailer insurance, including different types of coverage and what they protect against.

Key Considerations for Trailer Insurance

Liability Coverage

Liability coverage is one of the most critical aspects of trailer insurance. It protects you financially if you are found responsible for an accident that causes bodily injury or property damage to others. Here you need to know about liability coverage for trailers:

- Bodily Injury Liability: This covers medical expenses, lost wages, and legal fees if someone is injured in an accident involving your trailer.

- Property Damage Liability: This covers the cost of repairs or replacement of property damaged in an accident where your trailer is at fault.

Liability coverage is often required by state law, and the required limits can vary. Ensuring you have adequate liability coverage is essential to protect your assets in case of a serious accident.

Comprehensive and Collision Coverage

While liability coverage protects you from claims made by others, comprehensive and collision coverage protects your trailer from various types of damage.

- Comprehensive Coverage: This policy covers non-collision-related incidents such as theft, vandalism, fire, natural disasters, and falling objects. For example, if your trailer is damaged in a hailstorm or stolen from a storage lot, comprehensive coverage would help pay for the repairs or replacement.

- Collision Coverage: This covers damage to your trailer resulting from a collision, whether with another vehicle or an object (e.g., a fence or a tree). This coverage is particularly important if you frequently tow your trailer, as it ensures your trailer can be repaired or replaced after an accident.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is an optional but highly recommended addition to your trailer insurance policy. This coverage protects you if you are involved in an accident with a driver who either has no insurance or insufficient coverage to pay for the damages.

- Uninsured Motorist Coverage: Pays for injuries and damages caused by a driver who does not have insurance.

- Underinsured Motorist Coverage: Covers the gap between the other insurance limits and the actual cost of damages if their coverage is inadequate.

This type of coverage ensures that you are not left paying out-of-pocket for expenses that result from accidents with uninsured or underinsured drivers.

Additional Coverage Options

Depending on your needs and the type of trailer you own, you might consider additional coverage options:

- Contents Coverage: This covers personal belongings inside the trailer. It is particularly useful for travel trailers and campers, which often contain valuable personal items.

- Roadside Assistance: Provides help if your trailer breaks down while on the road. Services typically include towing, tyre changes, and battery jump-starts.

- Vacation Liability: This policy offers liability coverage while your trailer is parked and used as a temporary residence. It is ideal for RV owners who use their trailers for camping or extended stays.

Policy Bundling and Discounts

Many insurance providers offer discounts for bundling multiple policies. For example, if you insure both your car and trailer with the same company, you might receive a discount on both policies. Additionally, other discounts might be available for:

- Safety Features: Trailers equipped with anti-theft devices, alarms, or other safety features.

- Good Driving Record: Maintaining a clean driving record can often lead to lower premiums.

- Membership Discounts: Belonging to certain associations or clubs related to RVs and trailers.

State-Specific Requirements

Always ensure that your coverage meets or exceeds the minimum requirements mandated by your state. State laws can dictate the types and amounts of coverage you need, and failing to comply can result in fines, legal issues, or gaps in coverage.

In the next section, we will explore the benefits of having separate trailer insurance and how it can offer more comprehensive protection compared to relying solely on your auto insurance policy.

Benefits of Separate Trailer Insurance

When it comes to insuring your trailer, relying solely on your auto insurance to provide coverage can often leave gaps that could prove costly in the event of an accident or theft. Separate trailer insurance offers distinct advantages that enhance protection, financial security, and peace of mind. Here are the key benefits of opting for a dedicated trailer insurance policy:

Enhanced Coverage Specific to Trailers

- Customized Protections: Separate trailer insurance policies are specifically designed to address the unique risks associated with different types of trailers. Whether you own a utility trailer, travel trailer, or boat trailer, these policies can be tailored to include coverage for physical damage, theft, and specific liabilities that may not be covered under a standard auto insurance policy.

- Higher Coverage Limits: Trailers, especially those used for recreational purposes or commercial activities, often require higher coverage limits due to their higher value and the potential for more significant financial loss. Separate trailer insurance allows you to set limits that are appropriate for the value of your trailer and the risks involved, providing better protection against potential losses.

Financial Security

- Dedicated Claims Handling: Having a separate policy means that claims involving your trailer are handled independently of your auto insurance. This can lead to more straightforward claims processing and potentially less impact on your vehicle insurance rates in the event of a trailer-related claim.

- Reduced Out-of-Pocket Expenses: Adequate coverage minimizes the financial impact of damages or losses to your trailer. For example, if your trailer is damaged in a storm or if items within your travel trailer are stolen, the right coverage can help cover these costs without significant out-of-pocket expenses.

Legal Compliance

- State Requirement Fulfillment: As discussed, some states have specific insurance requirements for trailers. A separate trailer insurance policy ensures that you meet these legal requirements, avoiding potential fines and legal complications.

- Liability Protection: Trailers can pose significant liability risks, especially if they detach or cause an accident while on the road. Separate liability coverage in your trailer insurance protects you against claims for bodily injury or property damage caused to others, which might not be fully covered under your auto liability section.

Peace of Mind

- Comprehensive Protection While Parked: For those who use trailers as part of their lifestyle, such as travel trailers used for vacations, separate insurance can offer coverage options like vacation liability and contents insurance, which protect while the trailer is parked and being used as a residence.

- Roadside Assistance: Many trailer insurance policies offer optional roadside assistance, which can be invaluable if you face a breakdown or an issue with your trailer while travelling. This can include towing, flat tyre changes, and other roadside help, ensuring that help is available no matter where your adventures take you.

Flexibility in Policy Features

- Customizable Deductibles and Features: Separate trailer insurance policies typically offer flexibility in choosing deductibles and coverage features, allowing you to balance the cost of premiums with the level of protection you need. This can be particularly beneficial for those who require specific features such as higher limits for contents or additional liability coverage.

In conclusion, separate trailer insurance provides tailored, comprehensive coverage that enhances your financial security, ensures compliance with state laws, and offers peace of mind during your travels. Next, we will delve into how to choose the right trailer insurance, focusing on assessing your needs, comparing policies, and finding the best rates.

How to Choose the Right Trailer Insurance

Selecting the right trailer insurance involves more than just finding the lowest premium; it requires understanding your specific needs, comparing different policies, and considering various factors that affect coverage and cost. Here are essential steps to guide you in choosing the most suitable trailer insurance:

Assessing Your Needs

- Identify the Type of Trailer: Different trailers have different insurance needs. For instance, a utility trailer’s insurance needs will differ significantly from those of a travel trailer or a boat trailer. Identify what risks are most relevant to your trailer type—whether it’s theft, environmental damage, or accidents.

- Evaluate the Trailer’s Value: Determine the current market value of your trailer. This will help you decide the amount of coverage you need to sufficiently protect your investment without overpaying for insurance.

- Consider Usage Frequency and Purpose: How often and for what purpose you use your trailer can significantly impact the type of insurance you need. Frequent use or commercial use often requires more comprehensive coverage compared to occasional personal use.

Comparing Policies

- Coverage Options: Review different coverage options available, such as liability, comprehensive, collision, and any additional coverage like roadside assistance or contents coverage. Make sure the policy covers all aspects you deem necessary for your peace of mind.

- Insurance Provider’s Reputation: Choose an insurance company with a good reputation for handling claims fairly and efficiently. Check customer reviews and ratings from trusted sources to gauge the insurer’s reliability and service quality.

- Claims Process: Understand the claims process of the insurance provider. A straightforward, transparent claims process can significantly reduce stress in the event of damage or theft.

Tips for Finding the Best Rates

- Get Multiple Quotes: Shop around and get quotes from several insurance providers to compare rates and coverage details. This not only helps you find the most competitive pricing but also gives you a broader perspective on what different insurers offer.

- Discount Opportunities: Inquire about any discounts for which you may be eligible. Common discounts include those for bundling policies, maintaining a clean driving record, installing safety devices on the trailer, or being a member of specific professional or recreational associations.

- Adjust Deductibles: Consider adjusting your deductibles to find a balance between monthly premiums and out-of-pocket costs in case of a claim. Higher deductibles generally lower your premiums, but make sure you can afford the deductible if you need to file a claim.

- Review Annually: Your needs and circumstances can change over time, as can the terms offered by insurance providers. Make it a habit to review your trailer insurance policy annually to ensure it still meets your needs and that you are still getting a competitive rate.

Conclusion

Choosing the right trailer insurance is about much more than compliance; it’s about protecting your assets, fulfilling legal requirements, and ensuring peace of mind. By carefully assessing your needs, comparing policies, and considering ways to get the best rates, you can find a trailer insurance policy that provides the protection you need at a price that fits your budget.

In the next section, we will share a unique personal opinion that provides additional insights into the importance of understanding state requirements and balancing cost with coverage.

Personal Opinion and Insight

The Balance Between Cost and Coverage: A Crucial Consideration

When it comes to trailer insurance, one of the most common dilemmas trailer owners face is balancing the cost of the insurance with the coverage provided. As someone deeply familiar with the intricacies of insurance policies, I’vII’vI’vI’I’vI’vI’veserveddncedsthand the impact of both under-insurance and over-insurance.

Understanding State Requirements: More Than Just Compliance

The requirement for trailer insurance varies significantly from state to state, which can be a source of confusion for many trailer owners. However, understanding these requirements is not just about legal compliance—it’iit’it’it’it’it’it’soutpreciatingtectiont these laws afford to trailer owners and others on the road. State mandates often reflect a minimum standard aimed at safeguarding both the property and the well-being of the public. Ignoring these can not only lead to fines and penalties but can also leave you exposed to significant financial risks in case of an accident or theft.

My Perspective on Insurance Needs

From my perspective, the key to selecting the right trailer insurance lies in a careful evaluation of your specific needs. This involves considering factors such as the type of trailer you own, its use, its value, and the potential risks associated with its operation. It is uncommon for trailer owners to underestimate the value of their assets or the potential costs associated with liability claims. This oversight can lead to choosing lower coverage limits to save on premiums, which might seem like a cost-effective strategy initially but can prove costly in the long run.

Conversely, over-insuring your trailer by selecting high coverage limits and additional features that go beyond your actual needs can unnecessarily increase your insurance costs. The ideal approach is a balanced one—opt for a policy that provides adequate protection without overextending coverage that does not provide proportional benefits.

The Importance of Professional Guidance

I strongly advocate seeking professional advice when choosing trailer insurance. Insurance agents who specialize in trailer and recreational vehicle (RV) insurance can provide insights that are not immediately apparent to most consumers. They can help you understand the nuances of different policies and guide you in making informed decisions that align with both your financial and protection goals.

Moreover, professional advice can be invaluable in navigating the complexities of state-specific regulations and ensuring that your coverage meets or exceeds the required standards. This professional insight ensures that you are not just compliant but also adequately protected against the diverse risks associated with trailer ownership.

Conclusion

In conclusion, choosing the right trailer insurance is a nuanced decision that requires a balance of cost, coverage, and compliance with state laws. While the temptation to minimize costs is understandable, it is essential to prioritize adequate coverage to safeguard against potential financial losses. Regularly reviewing your insurance needs and seeking professional advice can help ensure that your trailer insurance policy remains aligned with your needs and provides the necessary protection as those needs evolve.

Frequently Asked Questions (FAQs)

Does my truck insurance cover my trailer?

No, truck insurance does not automatically cover your trailer. Trailers generally require separate coverage because the risks and liabilities associated with towing a trailer are different from those of driving just a truck. It’IIt’It’spIt’It’sportantkh your insurance provider to determine if you need additional coverage for your trailer.

Do pull-behind campers need insurance?

Yes, pull-behind campers generally need insurance. Given that they often carry valuable personal belongings and are susceptible to a variety of risks, including accidents, theft, and natural disasters, having insurance is crucial. This not only protects your investment but also covers you for liability in case someone is injured in or around your camper.

How much is utility trailer insurance?

The cost of utility trailer insurance can vary widely based on factors such as the value of the trailer, the coverage limits you choose, the insurance provider, and your location. Generally, you can expect to pay anywhere from $100 to $500 per year for utility trailer insurance. For an accurate estimate, it’ssttesm ’ several insurance providers based on your specific needs.

Travel trailer insurance requirements in Texas?

In Texas, travel trailers must have liability insurance if they are to be towed on public roads. The state requires at least the minimum liability limits that are mandatory for motor vehicles. Owners are also encouraged to consider comprehensive and collision coverage to protect against physical damage to the trailer.

Florida travel trailer insurance requirements?

In Florida, while it’s mandatory to have separate insurance for travel trailers towed behind a vehicle, liability coverage extends from the towing vehicle insurance policy. However, a separate travel trailer insurance policy is recommended for comprehensive protection, including collision and comprehensive risks. This ensures that your trailer is protected against a range of potential issues like storm damage, theft, or accidents.

These FAQs aim to address common concerns and provide clear, straightforward information to help trailer owners make informed decisions about their insurance needs. If you have more specific questions or need further details, consulting with an insurance agent who specializes in trailer insurance can be incredibly beneficial.

Conclusion

Navigating the complexities of trailer insurance requires a thoughtful approach, particularly given the variability in state laws and the unique risks associated with towing and using trailers. Whether you own a utility trailer, a travel trailer, or any other type of trailer, understanding the insurance requirements and ensuring that you have adequate coverage is not just a legal necessity—it’s a critical component of responsible ownership.

This guide aims to equip you with the knowledge needed to make informed decisions about your trailer insurance. It provides a state-by-state breakdown of trailer insurance requirements and detailed insights into the types of coverage and their benefits. We discuss the importance of balancing cost with coverage and the advantages of securing a policy tailored to your specific needs and risks.

Remember, the goal of trailer insurance is to protect your investment, comply with legal requirements, and provide peace of mind while you are on the road. Regular policy reviews and consultation with insurance professionals can ensure that your coverage continues to meet your evolving needs.

In conclusion, take proactive steps to understand and fulfil your trailer insurance requirements. By doing so, you safeguard not only your financial interests but also contribute to the safety and security of your travels, no matter where your adventures take you.